YourFarm

At your fingertips

Problem Definition

Difficulty finding healthy food

Lack of information regarding the provenience of our food

Our idea started from the concerns regarding the provenience and quality of the food products of animal origin in Romania. As we gathered information from research papers concerning the people of Romania, we observed that "nine out of ten Romanians have taken action in the last 12 months to have a healthier lifestyle" [1]. Not only that, but "more than eight in ten Romanians (83%) associate a healthy lifestyle with food" [1]. In regards of food, paper [2] shows that 53% of Romanians are eco-supporters, 11% eco-promoters whilst the others are indifferent towards this type of alimentation.

Our Solution

Offering an online platform for free range farms to sell their products

Observe the farms and their domestic animals

The ability to traceback how end products were obtained

YourFarm proposes to connect farmers with customers. Our product is an online market where we enable users to buy products from farm animals and due to the fact that our clients are interested in a more transparent process, it allows them to see the farms at any moment in time, through video cameras.

Customer Segment

Average

health-concerned consumers

Average health-concerned consumers - After consulting our questionnaire, more than 75% of our respondents are concerned by the environment in which animals are raised (which most likely would have an impact in the product’s quality [6]). Thus, by giving them a product which can be supervised by them, we could attract more and more customers of this type.

Our main customer segment is any person which is health concerned, between 23 and 50 years old ([8]), with an above average monthly income, because at that age you start getting more concerned about your food intake, and your income could cover the costs of bio food, which is naturally more expensive than the average, factory-farm produced food. By providing healthy auditable products, we can be sure that our product would appeal to this type of people .

Competition

During our research analyzing the state of the art in this area, we have found the following possible competitors with their advantages and their lacking parts that we succeed in covering within our solution.

Lăptăria cu caimac - sells various healthy dairy products from their own farm, being involved in the whole process. The key difference is the fact that even though their variety of products is diverse, we offer customers the possibility of choosing more monitorable farms to buy products from.

VerdeFood - is a bridge between farmers and possible buyers, where you can either get specific products from farms, or as a farmer, you can sell your products to those customers. We have a similar approach but with a more transparent process.

Vreau din România - is more of a campaign from Kaufland where customers are encouraged to buy alleged romanian-produced products. Based on our research, given the fact that people are not that trustful in this kind of label, we can assure customers that the products that they receive from us are 100% Romanian.

RealFoods - is an online marketplace, a bridge between farmers and buyers. The differences between our product and this platform are the variety that they provide (not only animal products) and our possibility to watch over the farms, the animals and product processes.

Advantages Over Competition

You have diversity of farms to choose from

You can easily traceback all products to the farm and animals that produced them

You can observe in real time all the processes of the farm

Key Features - Revenue Streams

- See the farms (you can watch the animals and processes that happen inside the farms)

- Buy products from the marketplace (depending on the farm you want to buy from, you can see the list of all the available products)

- Product selling

- Base products (milk, eggs, etc)

- Manufactured goods (e.g. butter from milk)

- European funds

Cost Structure

When taking into consideration our solution, we have devided the costs it would imply in two categories:

- Farm Maintenances - money put into the acquisition and mantainance prices of the farm cameras and transport costs;

- Corportate Costs - money covering the technology expenses, marketing, etc.

Farm Maintenance | Corporate Costs |

Farm Infrastructure - Cameras | Office workers salaries |

Transport Costs | Marketing & Sales |

Taxes | |

Software Licenses | |

Servers and Domain Registration |

Key Metrics

Acquisition

- Website Traffic

- Number of users that entered the website

- Number of users that created an account

- Number of users that reached the magic moment

- clicked 'See Farms' button

- reached the list of farms

Main key metric

Activation

- Active purchasing (How many products are bought in a month)

- Internal market growth (Marketplace traffic)

Active subscriptions

Internal market growth

Active subscriptions

Cost of

customer

aquisition

Customer

loyalty

Net Profit Margin

Monthly website traffic

Retention

- Number of users that place orders monthly

Revenue

- Net Profit Margin

Number of users that entered the website -> We need to be sure that people are constantly checking our website and that it has enough visibility to the public.

Number of users that created an account -> By analyzing this, we can get a birds-eye view on how many users are truly interested in our product (on more of a long-term premise).

Number of users that clicked the 'See farms' button (the most important metric) -> This shows us what percentage of users are interested or curious in what we offer, being the gateway to our farm world and the Call to action button.

Active purchasing -> Shows us whether we need to expand our farms list or place more resources into advertising and marketing our product.

Market growth -> Shows us the evolution of our marketplace traffic.

Number of users that place orders monthly -> We need to be careful not to burn through all of our potential customers and to retain as many of them.

Market Research

First, we looked at the market as a whole, it being the agricultural market. By looking at statistics, we found out that the market value in this field is 25.6 billion RON [10]. But, being targeted on a niche, we started looking at the dairy products submarket. We applied the following formula for determining the size of our target submarket:

Market size = Number of Target Customers * Average Value for Milk * Penetration Rate

We looked at our target customers [11] and found out that one third of the Romanians are buying dairy products. By zooming on our determined age range, we approximated that our number would be around 3.3 million people.

For the average value, we approximated the price of one liter of milk at around 7 RON per liter.

The penetration rate is an approximation of the percentage of people that our product reaches to. We have done an optimistic approximation of 30%.

Thus, our market size would be at around 500 million RON.

Now let's look at the approximate number of players in this market. By looking at a report from the National Institute of Statistics [12], we see that the number of farms that work as a business is approximately 25 thousand. But they are not separated by the types of animals that they are growing. We can see that the percentage of cows in Romania is of 10%, so by doing a gross approximation, we estimate a number of around 2.5 thousand players in this market.

We proceed by looking at how our competition is doing. Unfortunately, we only found out details about the market share of one of our direct competitors, Lăptăria cu Caimac, which is 1% [13].

However, we also took a look at the biggest players in this market, Albalact with 20% in 2019, Hochland with 20% in 2019, Napolact with 8% in 2019, and Olympus with 6% in 2019.

We have also forecasted the evolution of this market. By analyzing the milk consumption over the years [14] and by using the same formula that we already used, we predicted how the market will grow in the next five years.

Our expectations on this difficult market are pretty optimistic. We believe that we would have a pretty slow evolution in our first four years, until we set up everything we want at our own standards. In the fifth year, we would like to see a boom which would grant us a 5% share of the market value, as represented in the next chart:

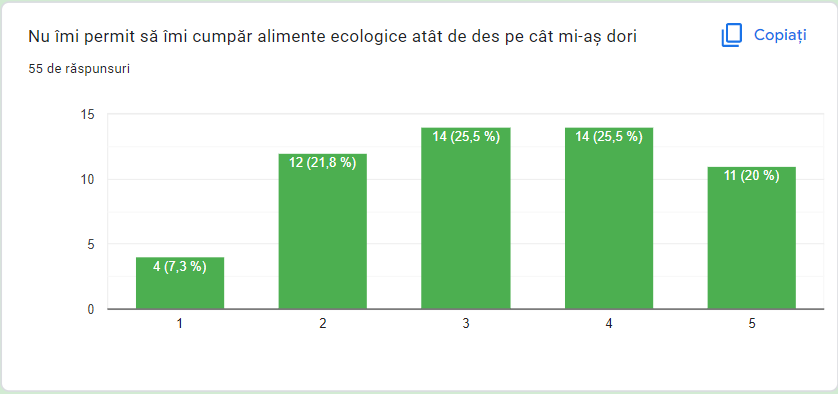

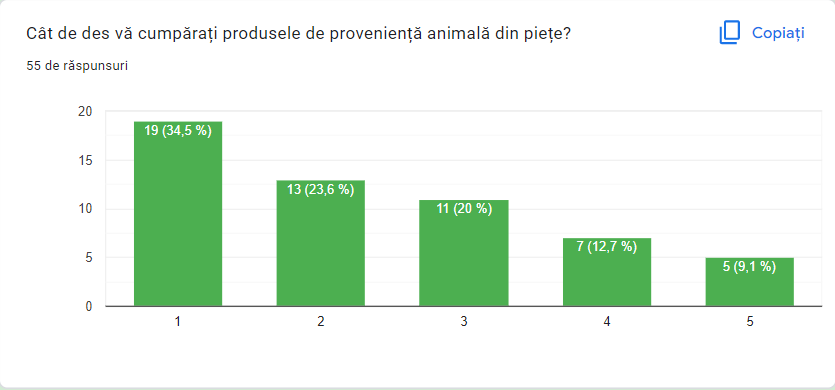

Questionnaires

After reviewing the feedback received and reconsidering our customer segment we restructured our questionnaire in order to have only specific and relevant questions for our area of interest:

Our questionnaire has two sections, make sure to check out both of them!

You need to answer the ones from the first page in order to reach the second one.

First Round Of Interviews - Questions

- What is your opinion about the eco-bio labels and how much trust do you have in them?

- Find what gives trust in products - what the health-conscious customer looks for when choosing what to buy and if it is enough for such a customer to see the label (or he/she wants another validation)

- What is your view on the price-quality raport of eco-bio food? Is it worth it?

- Check if the price is an important factor in buying eco products and if they are considered to be worth the difference in price

- Where do you buy your animal products and why? (specialised store, supermarket, market)

- Find the reasons for which people buy or not from farmer markets or shops like butcheries (convenience, price)

- The product provenience in which they trust the most and the seller

- How many times a week do you buy animal products? How many meals a day do you eat animal products?

- FInd how often the interviewee meets the problem we are trying to solve

First Round of Interviews

Second Round Of Interviews - Questions

After reviewing the feedback received and reconsidering the information we want to gather from the interviews, we have modified our most important questions.

- Where do you buy your animal products and why? (specialised store, supermarket, market)

- Find the reasons for which people buy or not from farmer markets or shops like butcheries (convenience, price)

- The product provenience in which they trust the most and the seller

- How many times a week do you buy animal products from a specialized store / farmers market?

- Figure out how often does the interviewee meet the problem that we are trying to solve and when solved, if our solution matches the current standards

- Which is the most important thing that you do for your health regarding your food and why?

- The actions made in the past for their health in order to see if our product fits their needs and would be realistically applicable in normal behaviour

- Do you have any trust in buying food online (excluding Bolt Food, Glovo, Tazz) and if not, why? What would make you trust in it?

- Find out their opinion on food products acquisition and what makes them hesitant to want an application like ours (doubts with transport, conditions, provenience)

- Did you use to receive food packages from your family or friends from the country side?

- Check how well they recognise the difference of food quality between supermarket and freerange products and how used they are to the rural area or raising animals in farms

Transcript of this interview

and 2 others that couldn't be recorded here

Conclusions After Insights

- People prefer food provided by freerange farms rather than factory farms and consider it better in many aspects (taste, health, satiety).

Andrei M. :

"I look for eco-bio food (meat, cheeze, eggs) because they are healthier."

Diana T. :

"I prefer buying animal products from markets and specialised stores (butcheries) because they are tastier, healthier and I trust the vendors more"

Octavian B. :

"Meat from a butcher's or from my own production is a big plus"

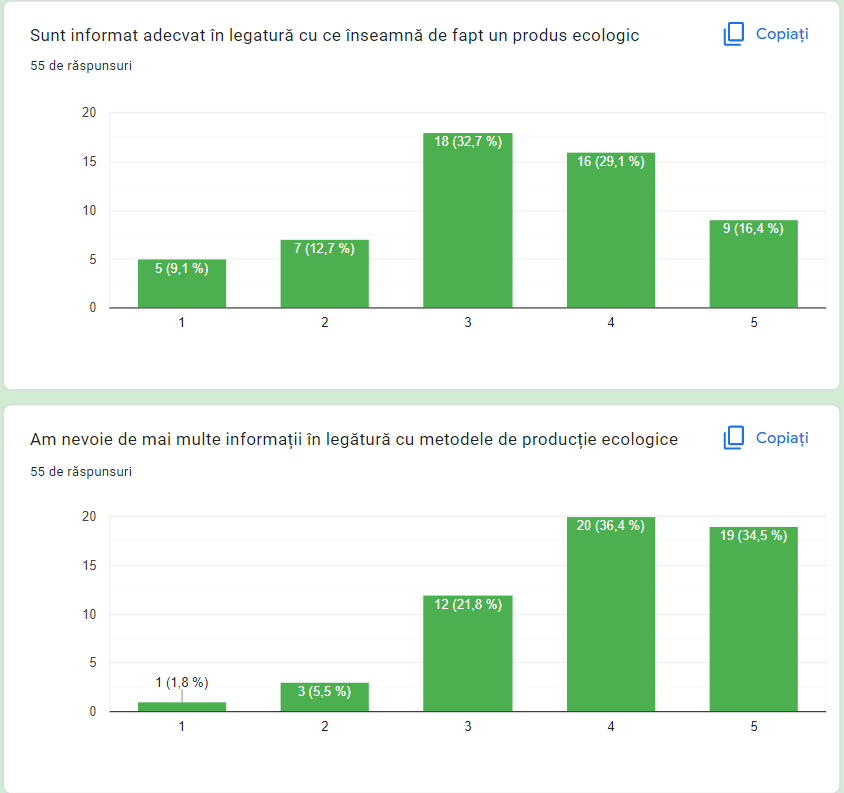

- People are not that informed regarding the methods of production of ecological food and would like and need more information about them.

Victor G. :

"I buy everything of animal provenience from the butchery and markets as it is of better quality, has better taste, smell and visibility of the process behind"

Octavian G. :

"I don't buy bio food. First of all, I think it is expensive. Second of all, I think it is a scam."

- Though they consider freerange farm food is better, they find it harder to obtain and afford.

Diana T. :

"I buy my food (milk, eggs, cheese) from supermarkets out of comodity once every two weeks in bigger quantities."

Daniel R. :

"I buy food from supermarkets out of comodity. I would prefer specialised stores but I don't have them around my house or my daily paths."

Andrei M. :

"I would like to buy from specialised stores but I don't have enough time and it is more convenient to buy from supermarkets."

Stefan T. :

"I am always careful of what I buy. Recently I bought an eco-bio egg formwork and all of them were with two yolks. I don't trust this label because it seems that anyone can obtain it easily."

Octavian G. :

"I have found local milk producers and I have observed that it has a more natural taste, so I try to buy more from them."

Interviews with Farmers - Questions

In order to find out whether this product would actually be useful and wanted from the farmers view, we have conducted some interviews to check on their opinion towards this kind of approach.

- What do you think is the most difficult part in creating and maintaining a farm?

- Understand their hardships in order to check if our solution would be of use to them

- Which is the biggest challenge that you have encountered and how did you solve it? If you did not solve it, what do you think you need in order to solve it?

- Take a more in depth look over their problems and challenges encountered

- Do you consider that the evolution of technology and the digital have affected your business and if so, in what way?

- See their openness towards digitalization and use of higher-technology

- Do you consider that the request of products coming from animals raised in freerange farms is at an appropriately high level? If not what do you think is the reason?

- Understanding better the market and submarkets of this area

- Do you think that in general the transparancy of what happens inside the farm and following the conditions of the animals and their products are important factors for clients?

- See how they perceive auditability in this general domain and their view on having a clearer outside look on their farm

- What is your view on selling products using a webiste? What about selling them through bigger stores?

- Check their view concerning expanding the places where the selling of their products happens and if our solution would be an improvement for them

- Is there any enhancement you wish for in this business area and if so, what prevented you from gaining it?

- Find the lacks and opportunities of development in this area

The most important discoveries taken from these interviews that validate the use of our product from the farmers point of view are that:

🐄 the major problems that farmers deal with are the product opening, the small number of willing farm workers and the bureaucracy;

🐄 the request of products from animals raised in freerange farms is high;

🐄 the transparancy and auditability would bring a great improvement by raising the clients' trust, improving the quality of the products and enlarging the product opening (more visibility and sales);

🐄 the selling of their products using an online market would ease the process and make it more successful.

Are we ready for Customer Validation? If we are to analyze, one of the biggest issues of our possible customers is the lack of time, most of them being forced to use supermarkets due to convenience issues. So, by offering them a platform in which the products can be ordered at their doorstep, we can eliminate this time restriction. Another problem would be reassuring them that the products received are really freerange, thus we offer them the way to watch over the farm animals and how the products were made. All things considered, we believe we are ready to pitch our idea to possible customers, well aware that farmers are also willing to collaborate.

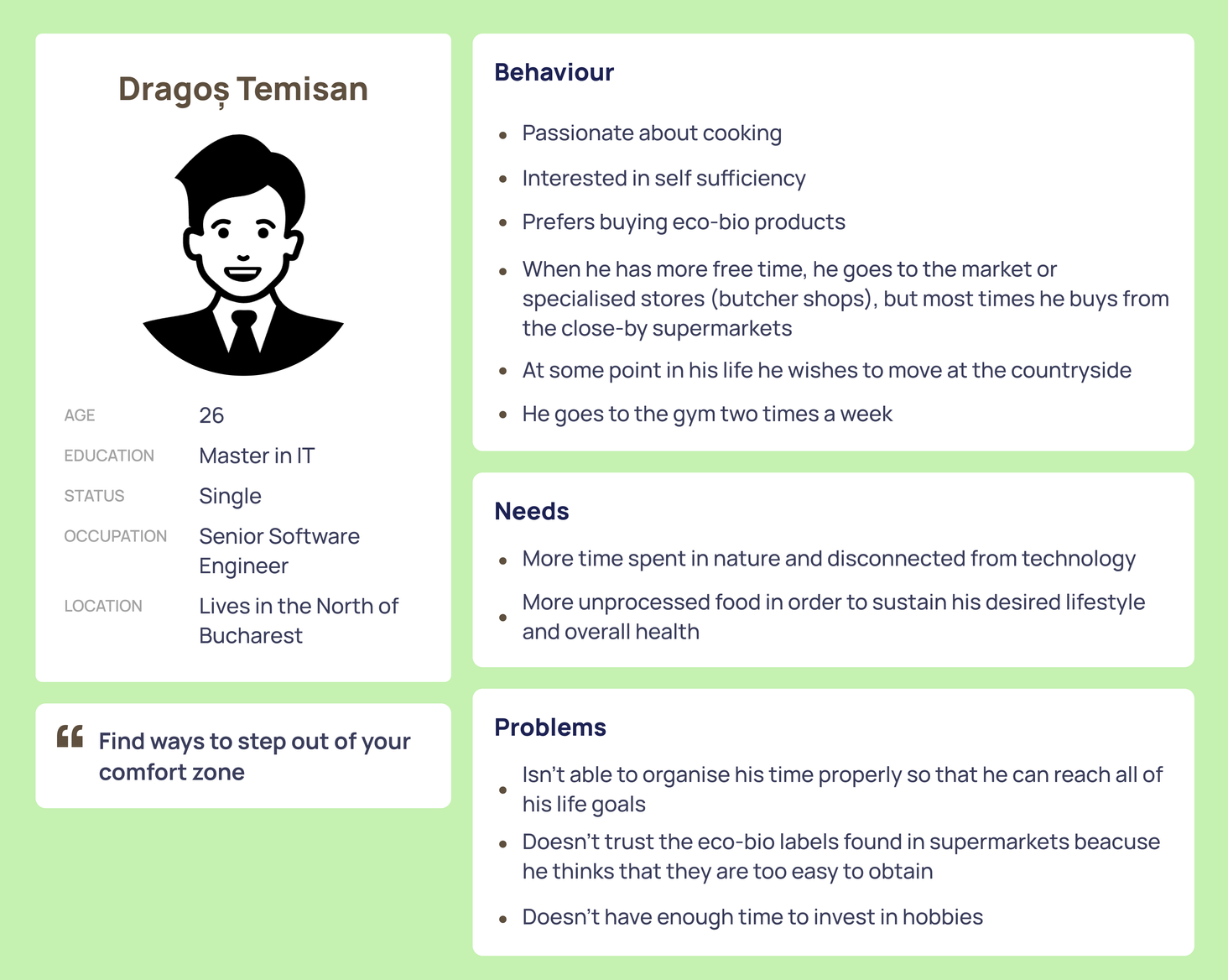

User Persona

User Stories

- Customers of YourFarm Marketplace

- As a user I want to be able to create an accout;

- As a user I want to be able to see the farms (animals and processes);

- As a user I want to be able to buy products from the marketplace.

User Flow

Wireframes

Landing Page

Authentication

Partnerships

Dashboard

Online Store

Shopping Cart

Farms

Flow

You can access a Figma "prototype" preview in which the wireframes are linked together accordingly. In order to see the flow of the pages, there are two possible actions: click (over elements like buttons and texts with hyperlink) and drag (between screens of the same page).

If you find it difficult to use this preview, you can see below a short tutorial of its usage applied on our project:

Behind the scenes, this is what it looks like:

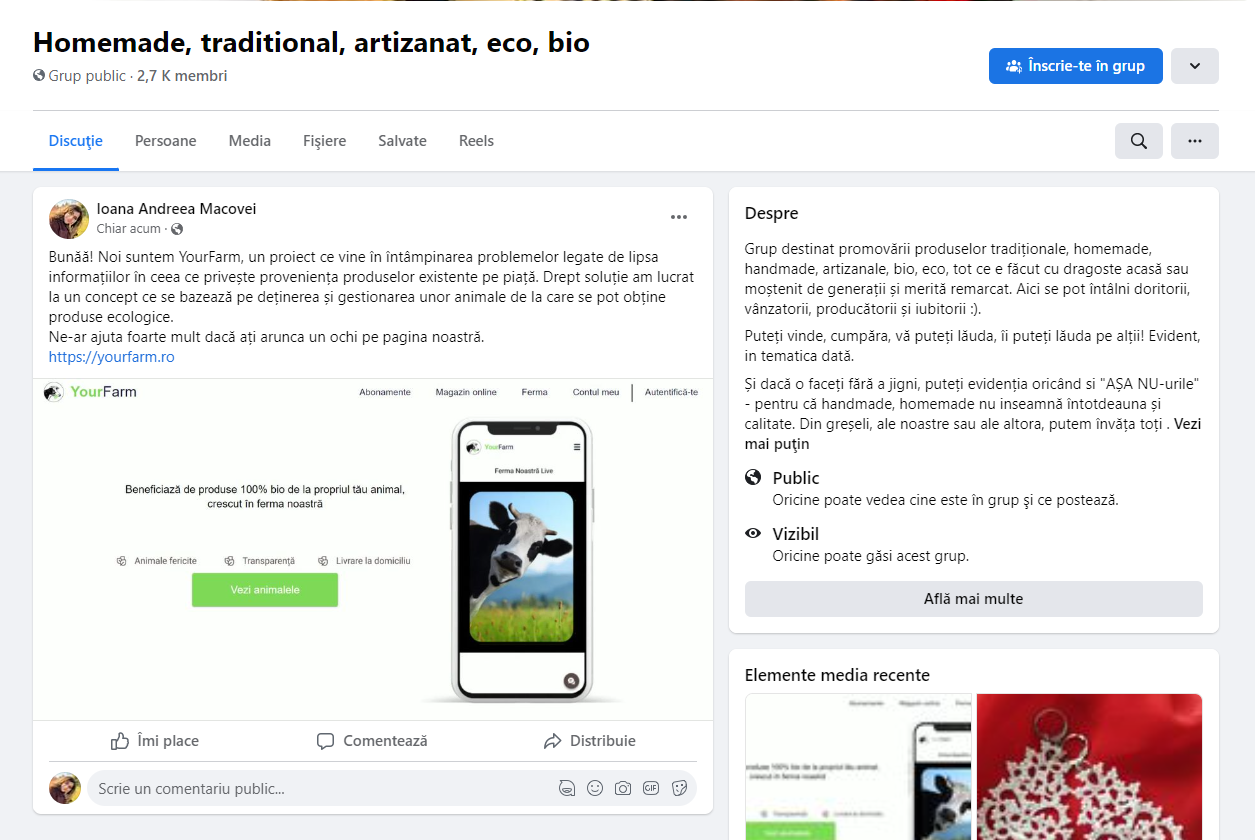

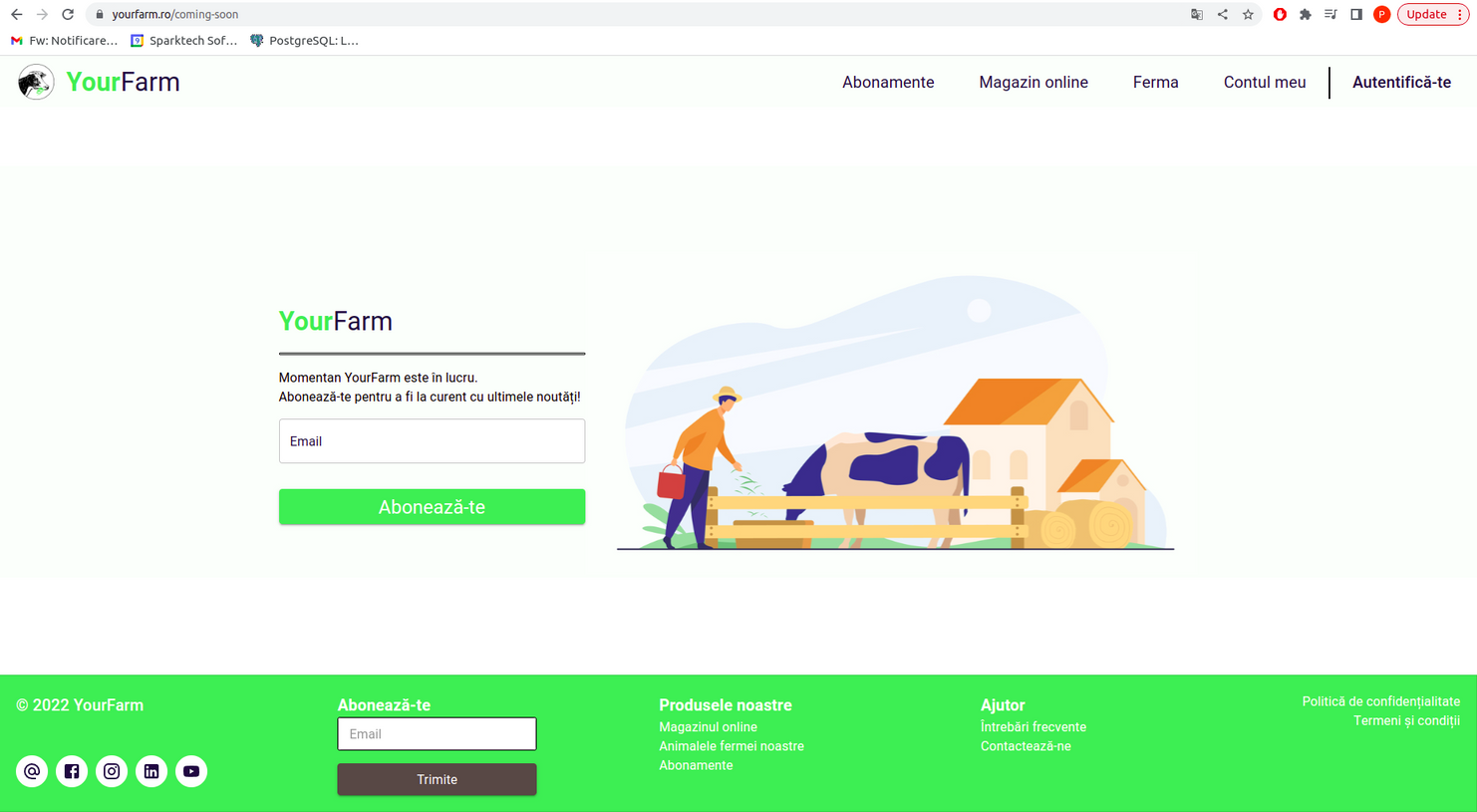

Showing Our Product To The World

In order to attract potential users before the launch, in the beginning, we only had implemented the Landing Page and a Comming Soon Page (we set up all of our buttons to redirect the user to it) in which they entered their e-mail, thus getting them subscribed to a newsletter which keeps them updated and hyped about our product till further implementation.

Minimum Viable Product

As we are interested in bringing to reality a clear overview of our business idea, we have focused all of our resources into creating a prototype with the most important features. As we are a bridge between farmers and customers, we have developed our MVP accordingly.

For regular customers, it can be observed that this version has the possibility to see the available (currently mocked) farms, to access the marketplace, place the wanted products (also currently mocked) into the shopping cart to simulate the process of buying (after you have your products chosen, you click 'Continue' in the shopping cart and you are redirected to the "Coming Soon" page - this will show us how many clients are willing to use our product at the moment).

If the user is a farmer, there is a dedicated contact page in order for him/her to be able to contact us and get more information about our vision, for possible collaborations. These concluded, our prototype solves the problem from which we started.

Another factor taken into account concerning the choice of the momentary project structure was that as we are not trying to prove retention, we have skipped over some of the functionalities of our final product (authentication, dashboard, list of orders, etc.).

Regarding the validation, we tried to conduct proper research over the market, understand the problems and check the use of our solution from both perspectives (the buyers/customers and the farmers), to gain a really thorough view over the real needs and expectations of our customer segment and partners. Due to the recent feedback and lack of time regarding applying all of the changes needed, as to be truly relevant to our validation, our fifth milestone is completed on the old concept of the product (and partially completed on the new one), which does show that people are at least curious about auditable farms and buying natural freerange products. All in all, we consider that our problem solution and business feasability are validated and the MVP is created with consideration to all of the above.

After the Final Presentation, the feedback we received was that a more efficient MVP for this moment in time, would be for example to get products from farms during a live video on social media (TikTok, Instagram) and sell it. Using this method, we would show in an easier manner, our key feature - auditability.

After the Midterm Presentation, taking into consideration the feedback and understanding that the first idea we developed our product on was not realistically a start-up (us owning an auditable farm) we have changed our concept and updated the fiki accordingly.

We did, though, consider important to show the following data found on the old version as well as on the current one, as we think it was a relevant step on our journey.

Attracting Our Customers

We have started our marketing campaign by trying to reach the potential customers that are closer to our age group, by posting a sneak peek of our page using Instagram Stories. We have created an Instagram account for our product where we would start posting updates about our product [9].

Even though we have tried the Instagram approach, we haven't ignored the opportunities of Facebook (Facebook Marketplace, Facebook groups, Facebook posts). We have also created a Facebook page for our product .

On our initial product, our Facebook page was not that descriptive and there were no posts. Also, the posts we shared on targeted facebook groups (focused on mentaining a healthy lifestyle) were from our personal profiles. We didn't place the screenshots of all the posts (there is one post underneath in order to show the idea) from the first concept because we considered it would take too much space unnecessarily but we did attach the links of the posts.

We tried to get our product in the hands of as many different people as possible. So, we started sharing the current prototype (developed on the new product concept), initially with close associates and colleagues, and we asked them to use our site (without any beforehand instructions) in order to see how they would behave and if it is suitable to be shared publicly. After that, we began advertising our product (this time from the YourFarm Facebook page) on the same targeted Facebook Groups as before (we considered the groups we chose first to be the most relevant in the domain) .

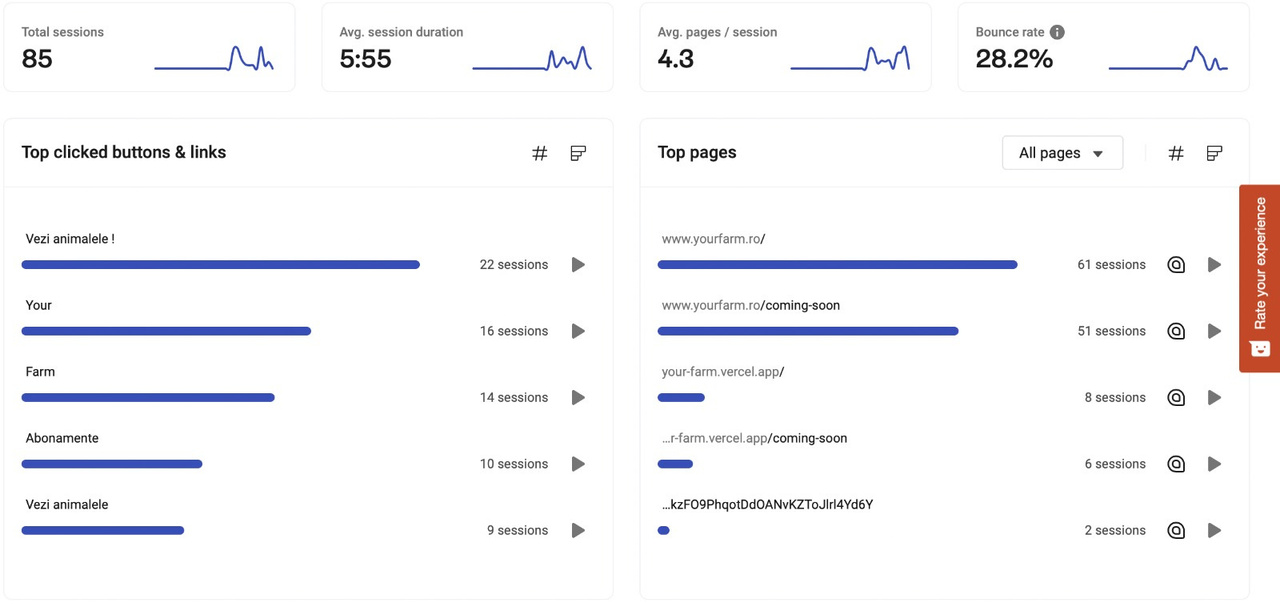

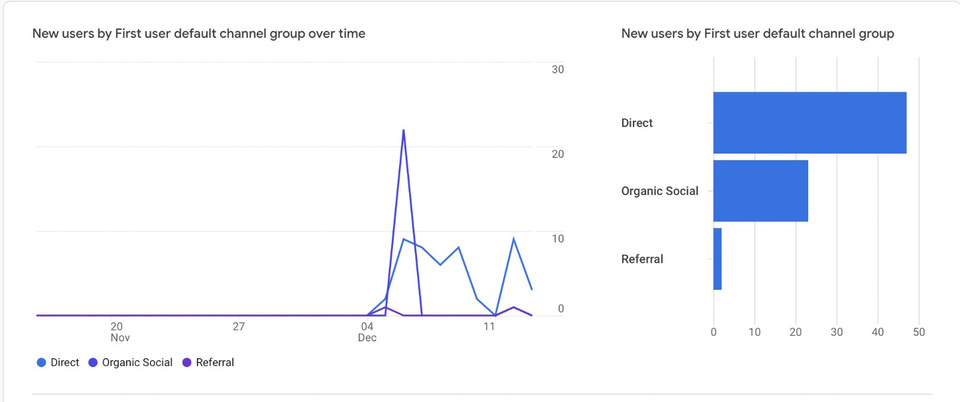

Getting Our Metrics

We used the folllowing:

- Screen Recordings : in order to track how easy it is for users to navigate through our UI.

- Heatmaps : to see what gets our users' attention.

- Charts : to track the number of visitors and calculate the conversion rate.

We collected data and as it can be seen below we had a small number of people that were curious in the product.

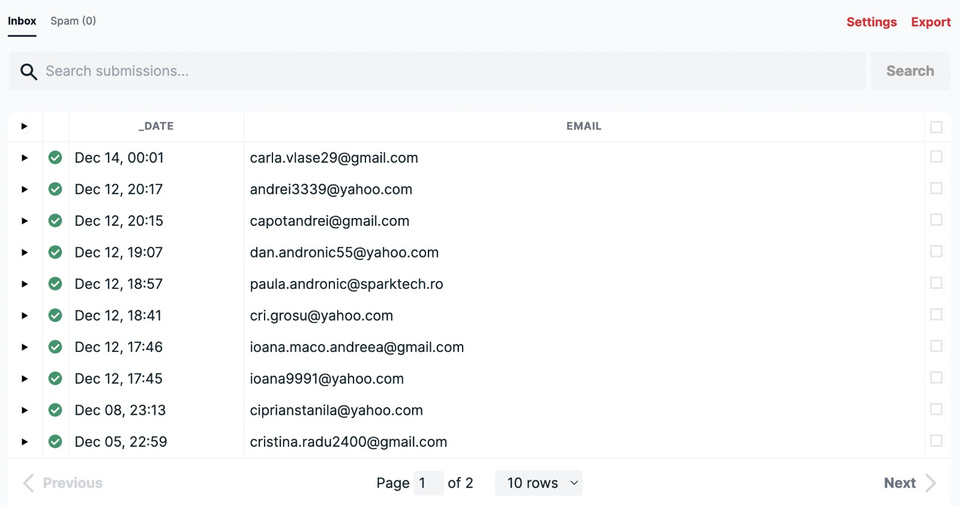

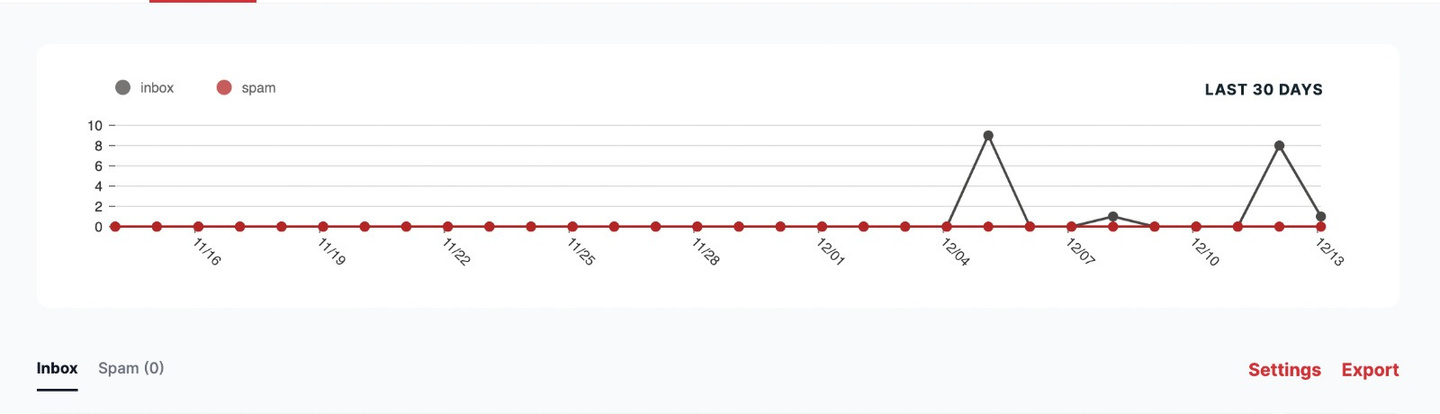

Emails registered in Formspree

In order to understand if our product is truly desired, we have been monitoring the whole traffic on the page, more specifically: how many people access the "Vezi fermele" section, how many people access the marketplace and try to buy something, and how many people come to the marketplace after checking the farm livestreams (more exactly, their specific path when using the application ).

New emails registered in Formspree

There were two problems met when gathering the data from the heatmap point of view. First of all, the software doesn't show us how many people clicked on the videos (Hotjar cannot track iframes embedded on the page). Then, when we made the structure of the platform, we considered the Shopping Cart as a Modal on the Marketplace page, and as it can be seen above, we cannot see the heatmap of it.

A major thing we realized, by looking over the statistics, was that people weren't using the Call to Action button as much as we thought they will. The Marketplace Page was accessed more than the Farms one which raised us some questions. Because we wanted to understand better why that was, we asked some new users to go over the page whilst showing us their process and the conclusion extracted was that some of them did not understand that the "Vezi Fermele" button would show them the farms live, rather thought that it would only show them more details about the farms.

Overall, we consider that our prototype did raise some interest and we believe it is a promising start for our product. These are some of the aspects we are going to work further on as enhancements, as well as developing the other features of the final product and bringing a more appropriate approach to the MVP.

Bibliography

- THE PROFILE OF THE ORGANIC FOOD CONSUMER IN ROMANIA: A REVIEW

- Ecological alimentation: a Romanian consumer behavior case study

- Green Behaviour of the Romanian Consumers

- ROMANIAN ORGANIC FOOD – STUDY ON CONSUMER BEHAVIOUR

- Romanian farmers` market. A multinomial logit model approach

- Consumer perceptions, preferences, and behavior regarding pasture-raised livestock products: A review

- Assessing the Importance of Health in Choosing a Restaurant: An Empirical Study from Romania

- Consumer segments in organic foods market

- The most popular social media sites in 2022

- Romania in numbers 2019

- Romanians and milk

- Agriculture in Romania

- Laptaria cu Caimac on the market

Our Team

Stefan Toma

Frontend Developer

Paula-Diana Andronic

Frontend Developer

Ciprian Stănilă

DevOps Engineer

Ioana-Andreea Macovei

UI/UX Designer